印度25年的电信基础设施行业

塔和基础设施提供商协会总干事T.R.Dua表示:“电信基础设施提供商将在实现印度政府的变革性和革命性举措方面发挥关键作用,并将在Bharatnet和智慧城市使命等各种项目下培养合作伙伴关系,通过创建强大的电信基础设施来加强连接。”

塔和基础设施提供商协会总干事T.R.Dua表示:“电信基础设施提供商将在实现印度政府的变革性和革命性举措方面发挥关键作用,并将在Bharatnet和智慧城市使命等各种项目下培养合作伙伴关系,通过创建强大的电信基础设施来加强连接。”

In the beginning the Government issued two cellular licenses per telecom circle followed by allocation of third cellular license to BSNL\/ MTNL in 2000. In 2001, 4h cellular license was awarded through auction. Between 2003 and 2008, the Unified Access service license was awarded based on the price arrived for 4th cellular license. Pursuant to Supreme Court order in 2012, the spectrum was auctioned, and auction continue to be the norm today.<\/p>

The telecom tower Industry has played a critical pivotal role in the unhindered growth of India\u2019s telecom sector. It is quite evident that the growth of telecom services could not have been possible without a robust and ubiquitous telecom infrastructure.<\/p>

Evolution of Telecom infrastructure Industry in India<\/strong><\/p> In 2000, The Telecom Infrastructure Industry came into existence with DoT inviting applications for IP-I registrations. Prior to that, telecom service providers were installing towers and other passive infrastructures on their own and there was no sharing. Even up to 2005, the telecom towers were being operated under integrated model and no sharing was taking place. Only a few operators shared towers on barter system. However, post 2005, the tower industry evolved under independent tower companies which maintain and install assets like tower and related infrastructure for renting\/ leasing to telecom service providers for providing cellular telecom services. Thus, the concept of sharing became popular as the towers were shared in a non- discriminatory, transparent, and cost- effective manner, by a neutral\/ independent infrastructure service provider. The telecom sector requires continual investments for ever increasing capacity and coverage requirements as well as due to technology evolution. The tower companies\/ IPs reduced the capex burden on telecom operators and brought in much needed investments through a novel concept of \u201csharing\u201d.<\/p> The sharing model resulted into huge savings for the sector in terms of capex, opex and brought in energy efficiencies as well as significant reduction in Carbon footprint including duplication of resources. The model has led to faster geographic rollout, improved quality of service and lower prices for consumers. Over a period of time, the infrastructure providers gained expertise in their core operations leading to skilled man- power, efficiency in operation and maintenance and reduced energy expenses. The tower sharing has been the benchmark concept globally and has become a Harvard Business study.<\/p> Advantages of passive infrastructure sharing model<\/strong><\/p> The sharing model has many direct and indirect benefits. The major benefits are given below:<\/p> The advent of Infrastructure providers \u2013 1 (IP -1) industry has helped in shaping the growth of the entire ICT eco system. Telecom infrastructure is the backbone of \u201cDigital India\u201d program. Telecom infrastructure providers are going to play a key role in realisation of transformative and revolutionary initiatives of the Government of India and will foster partnerships under its various programs like Bharatnet and Smart city mission to enhance connectivity by creation of robust telecom infrastructure. A robust telecom infrastructure will play a key role in a seamless connectivity, which is the essence of true digitisation.<\/p> To summarise, the infrastructure providers are in the transformational mode to support the data centric growth in telecom series which would continue to grow as the technology evolves to 5G and aided by reduced data prices, smart phones and mobile applications. The policy reforms like enhancement in scope for IP 1, rationalisation of taxes and duties i.e. property taxes and administration fee, securitisation of telecom infrastructure, single window clearance and availability of Government lands\/ buildings would provide tremendous impetus to the telecom infrastructure sector.<\/p> 这段旅程实际上始于1994年,当时,根据1991年的新经济政策,政府向私人投资开放了电信部门。1997年,印度电信管理局(Telecom regulatory Authority of India)将电信部的监管职能剥离给了一个独立的监管机构。BSNL从电信部分离出来,将其政策职能和电信业务分离。随后,随着2000年《TRAI法案》的修订,成立了一个上诉机构TDSAT,以解决争端。 最初,政府为每个电信圈颁发了两个蜂窝许可证,然后在2000年将第三个蜂窝许可证分配给BSNL/ MTNL。2001年,4h蜂窝牌照通过拍卖获得。在2003年至2008年期间,统一接入服务许可证是根据第4个蜂窝许可证的价格授予的。根据最高法院2012年的命令,频谱被拍卖,拍卖今天仍然是常态。 电信塔行业在印度电信行业的不受阻碍的增长中发挥了关键的关键作用。很明显,如果没有强大和无处不在的电信基础设施,电信服务的增长是不可能的。 印度电信基础设施产业的发展 2000年,电信基础设施行业诞生,DoT邀请IP-I注册申请。在此之前,电信服务提供商自己安装信号塔和其他被动基础设施,没有共享。直到2005年,电信塔仍在综合模式下运营,没有共享。只有少数运营商在物物交换系统中共享塔。然而,在2005年之后,塔行业在独立的塔公司下发展,这些公司维护和安装塔和相关基础设施等资产,以出租给电信服务提供商,以提供蜂窝电信服务。因此,共享的概念变得流行起来,因为塔楼由中立/独立的基础设施服务提供商以非歧视性、透明和成本效益的方式共享。 电信部门需要持续投资,以满足不断增长的容量和覆盖需求,以及技术发展。基站公司/ ip降低了电信运营商的资本支出负担,并通过“共享”的新概念带来了急需的投资。 共享模式在资本支出、运营成本方面为该行业带来了巨大的节省,并带来了能源效率,以及包括资源重复在内的碳足迹的显著减少。这种模式加快了地理布局,提高了服务质量,并降低了消费者的价格。经过一段时间,基础设施供应商在其核心业务方面获得了专业知识,从而获得了熟练的人力、运营和维护效率,并降低了能源费用。塔楼共享已成为全球的基准概念,并已成为哈佛商学院的一项研究。 被动式基础设施共享模式的优点 共享模式有许多直接和间接的好处。主要好处如下: 基础设施提供商-1 (IP -1)行业的出现帮助塑造了整个ICT生态系统的增长。电信基础设施是“数字印度”计划的支柱。电信基础设施提供商将在实现印度政府的变革性和革命性举措方面发挥关键作用,并将在Bharatnet和智慧城市使命等各种项目下促进合作,通过创建强大的电信基础设施来加强连接。强大的电信基础设施将在无缝连接中发挥关键作用,这是真正数字化的本质。 综上所述,基础设施提供商正处于转型模式,以支持以数据为中心的电信系列增长,随着技术向5G发展,并在数据价格下降、智能手机和移动应用程序的帮助下,这一增长将继续增长。政策改革,如扩大知识产权1的适用范围、税项合理化(即物业税和行政费)、电信基础设施证券化、单一窗口清关和政府土地/建筑物的供应,将为电信基础设施行业提供巨大的推动力。 免责声明:所表达的观点仅代表作者,ETTelecom.com并不一定订阅它。乐动体育1002乐动体育乐动娱乐招聘乐动娱乐招聘乐动体育1002乐动体育etelecom.com不对直接或间接对任何人/组织造成的任何损害负责。

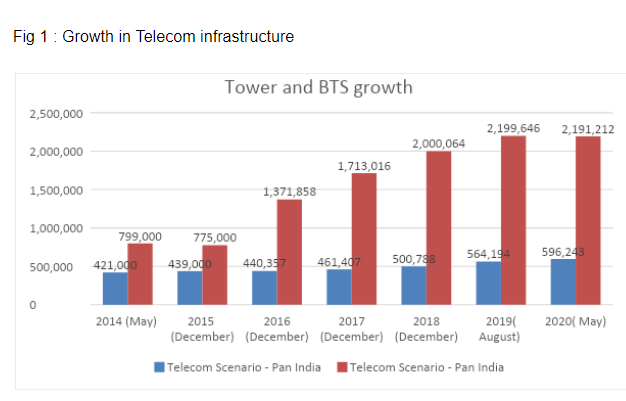

The telecom sector has been seeing a robust infrastructure growth, as evident from the above graph. As on February 2010, there were only 3,10,000 towers catering to 4,83,333 BTSs.<\/p>

<\/p>","blog_img":"retail_files\/blog_1596195658_temp.jpg","posted_date":"2020-07-31 17:10:59","modified_date":"2020-07-31 17:10:59","featured":"0","status":"Y","seo_title":"25 years of telecom infrastructure industry In India","seo_url":"25-years-of-telecom-infrastructure-industry-in-india","url":"\/\/www.iser-br.com\/tele-talk\/25-years-of-telecom-infrastructure-industry-in-india\/4413","url_seo":"25-years-of-telecom-infrastructure-industry-in-india"}">

从上图中可以明显看出,电信行业的基础设施一直在强劲增长。截至2010年2月,中国只有3万座基站,提供483333个bts服务。

In the beginning the Government issued two cellular licenses per telecom circle followed by allocation of third cellular license to BSNL\/ MTNL in 2000. In 2001, 4h cellular license was awarded through auction. Between 2003 and 2008, the Unified Access service license was awarded based on the price arrived for 4th cellular license. Pursuant to Supreme Court order in 2012, the spectrum was auctioned, and auction continue to be the norm today.<\/p>

The telecom tower Industry has played a critical pivotal role in the unhindered growth of India\u2019s telecom sector. It is quite evident that the growth of telecom services could not have been possible without a robust and ubiquitous telecom infrastructure.<\/p>

Evolution of Telecom infrastructure Industry in India<\/strong><\/p> In 2000, The Telecom Infrastructure Industry came into existence with DoT inviting applications for IP-I registrations. Prior to that, telecom service providers were installing towers and other passive infrastructures on their own and there was no sharing. Even up to 2005, the telecom towers were being operated under integrated model and no sharing was taking place. Only a few operators shared towers on barter system. However, post 2005, the tower industry evolved under independent tower companies which maintain and install assets like tower and related infrastructure for renting\/ leasing to telecom service providers for providing cellular telecom services. Thus, the concept of sharing became popular as the towers were shared in a non- discriminatory, transparent, and cost- effective manner, by a neutral\/ independent infrastructure service provider. The telecom sector requires continual investments for ever increasing capacity and coverage requirements as well as due to technology evolution. The tower companies\/ IPs reduced the capex burden on telecom operators and brought in much needed investments through a novel concept of \u201csharing\u201d.<\/p> The sharing model resulted into huge savings for the sector in terms of capex, opex and brought in energy efficiencies as well as significant reduction in Carbon footprint including duplication of resources. The model has led to faster geographic rollout, improved quality of service and lower prices for consumers. Over a period of time, the infrastructure providers gained expertise in their core operations leading to skilled man- power, efficiency in operation and maintenance and reduced energy expenses. The tower sharing has been the benchmark concept globally and has become a Harvard Business study.<\/p> Advantages of passive infrastructure sharing model<\/strong><\/p> The sharing model has many direct and indirect benefits. The major benefits are given below:<\/p> The advent of Infrastructure providers \u2013 1 (IP -1) industry has helped in shaping the growth of the entire ICT eco system. Telecom infrastructure is the backbone of \u201cDigital India\u201d program. Telecom infrastructure providers are going to play a key role in realisation of transformative and revolutionary initiatives of the Government of India and will foster partnerships under its various programs like Bharatnet and Smart city mission to enhance connectivity by creation of robust telecom infrastructure. A robust telecom infrastructure will play a key role in a seamless connectivity, which is the essence of true digitisation.<\/p> To summarise, the infrastructure providers are in the transformational mode to support the data centric growth in telecom series which would continue to grow as the technology evolves to 5G and aided by reduced data prices, smart phones and mobile applications. The policy reforms like enhancement in scope for IP 1, rationalisation of taxes and duties i.e. property taxes and administration fee, securitisation of telecom infrastructure, single window clearance and availability of Government lands\/ buildings would provide tremendous impetus to the telecom infrastructure sector.<\/p>

The telecom sector has been seeing a robust infrastructure growth, as evident from the above graph. As on February 2010, there were only 3,10,000 towers catering to 4,83,333 BTSs.<\/p>

<\/p>","blog_img":"retail_files\/blog_1596195658_temp.jpg","posted_date":"2020-07-31 17:10:59","modified_date":"2020-07-31 17:10:59","featured":"0","status":"Y","seo_title":"25 years of telecom infrastructure industry In India","seo_url":"25-years-of-telecom-infrastructure-industry-in-india","url":"\/\/www.iser-br.com\/tele-talk\/25-years-of-telecom-infrastructure-industry-in-india\/4413","url_seo":"25-years-of-telecom-infrastructure-industry-in-india"},img_object:["retail_files/blog_1596195658_temp.jpg","retail_files/author_1483009921_temp.jpg"],fromNewsletter:"",newsletterDate:"",ajaxParams:{action:"get_more_blogs"},pageTrackingKey:"Blog",author_list:"Tilak Raj Dua",complete_cat_name:"Blogs"});" data-jsinvoker_init="_override_history_url = "//www.iser-br.com/tele-talk/25-years-of-telecom-infrastructure-industry-in-india/4413";">